[ad_1]

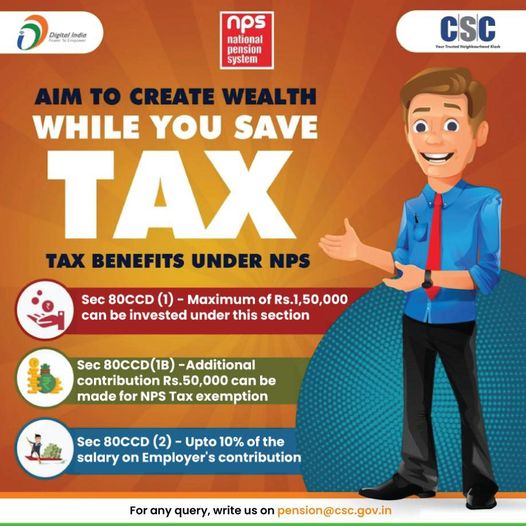

Aim to create wealth while saving tax by investing in NPS!

Tax Benefits under NPS:

Sec 80CCD (1) – Maximum of Rs. 1.50 lakh can be invested.

Sec 80CCD (1B) – Additional contribution of Rs. 50,000 can be made for tax exemption.

Sec 80CCD (2) – Upto 10% of the salary on Employer’s contribution.

For any query, pls write to pension@csc.gov.in

#Awareness #online #DigitalIndia #financial #money #financialinclusion #NPS #pension #Tax #security #socialsecurity

[ad_2]

Source